Financing model

The LLF finances health, agriculture, and basic infrastructure projects. Investments focus on improving access to quality primary healthcare and infectious disease control, improving staple productivity and livelihoods of small-holder farmers, and basic infrastructure projects like water and sanitation or off-grid power solutions, to provide marginalized communities the same opportunities for growth as are afforded to others.

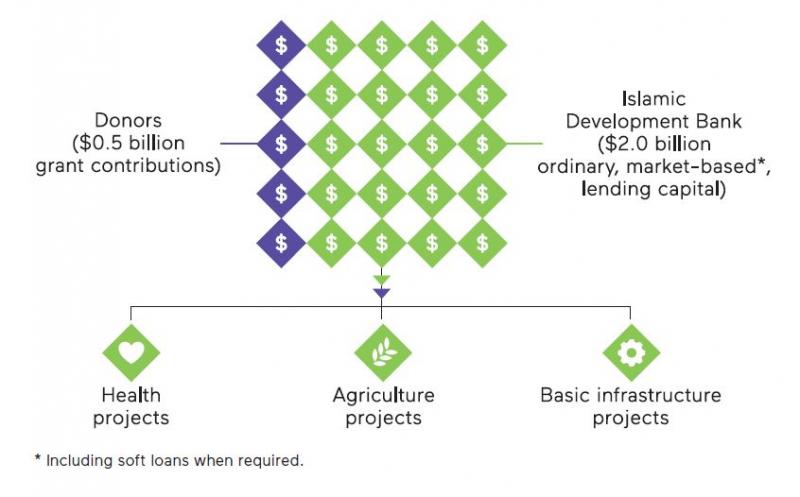

The unique financing model increases access of member countries to affordable financing for critical social development projects. LLF financing blends grant resources from regional and international donors with market-based ordinary project financing of the IsDB to offer highly concessional funding.